For reasons undisclosed I am deeply interested in coffee (not in the, “there’s nothing that makes me interesting so I chose coffee as my hobby and have an $8k espresso machine at home” way and more of the “I’m on the board of a non-profit that works with coffee producers at origin” way) and have been introduced to the historical world of commodities trading this year.

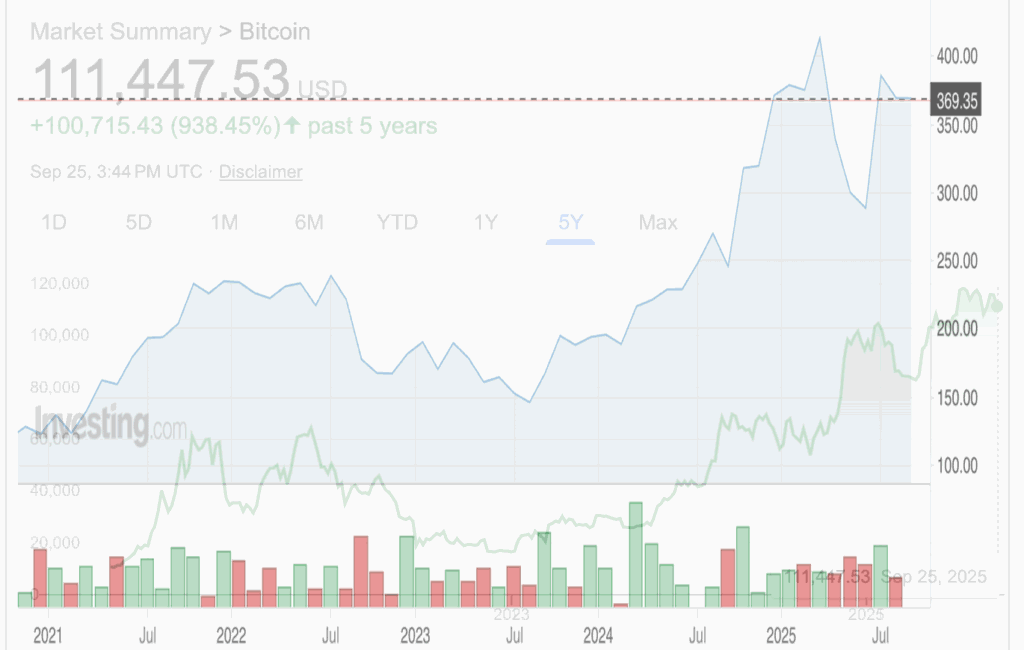

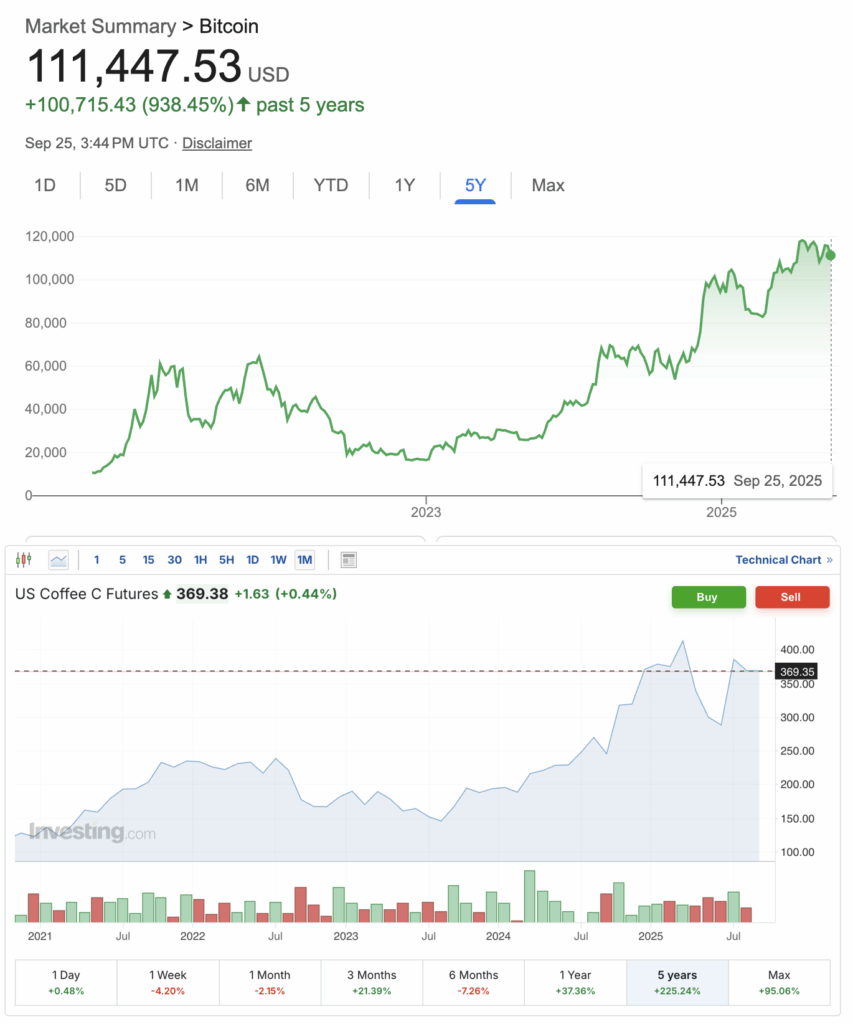

Imagine my surprise while stress-watching the $BTC price chart along with the KC=F price and noticing an eerily similar pattern. Well, turns out:

Coffee futures and Bitcoin have moved in sync for the last 5 years.

That’s not a typo. Zoom out, overlay the charts, and the trendlines are the same:

which one is which? same chart again:

In Numbers:

☕️ Coffee: up 225% ₿ Bitcoin: up 938% → Both peaked in mid-2022 → Both dumped in 2023 → Both went full vertical in 2024

And today, my latte is apparently a risk-on asset.

What’s Causing the Shift for Each?

The primary macro force behind coffee prices “could” be rainfall in Brazil. Brazil products a large majority of the world’s coffee. Crop yield, fungal infections, temperature bands. It’s a climate story.

Layer on this year’s governance changes in the USofA. Sudden and sweeping tariffs (driven by various personal and global happenings) are causing large amounts of volatility as the world tries to navigate a general sense of “wtf is happening.”

what about Bitcoin?

Setting the larger story of crypto and regulation changes aside, Bitcoin continues to be one of the best performing assets of our lifetime. Bitcoin’s sweeping growth comes partially from what it represents (an alternative to traditional banking systems that keep citizens at the whim of what governments decide to do), but mainly what we (the people, governments, and powers that be) have manifested Bitcoin into. Value, after all, is only what someone assigns to it.

Is the Correlation Real?

It is. But why?

To hypothesize:

- Commodities & Store of Value Convergence Bitcoin has long been compared to gold. But in a high-volatility world, even niche commodities like coffee start behaving like hedges.

- Speculative Flow Echoes When real rates are low and liquidity is high, both crypto bros and coffee traders pile in. Decaf goes risk-on.

- AI Trading Overlap If you think GPT-powered algos aren’t picking up trend-following patterns across uncorrelated assets, you’re not paying attention. Coffee might be caught in the same momentum funnels as BTC.

- Narrative Symmetry 2021: “Bitcoin fixes this.” 2024: “Single-origin Arabica from Minas Gerais fixes this.”

The biggest irony? Coffee is perishable. Bitcoin is eternal-ish.

But they’re now both:

- Heavily traded

- Highly narrative-driven

- Impacted by geopolitical and environmental shocks

- Spiking during risk-on bull cycles

- Dumping when rates go up

TLDR:

The lines are blurring.

Everything is a trade.

Number go up.